I've Shipped 3 Solana Smart Contracts. Most of Web3 Is Still Useless.

I joined Automatio.io in July 2022 with zero blockchain experience. Since then I've written three production Anchor smart contracts for Moonly, contributed to an open-source Solidity IDE under Hyperledger, and shipped 829 commits across a monorepo with 36 applications. I believe in what this technology can do.

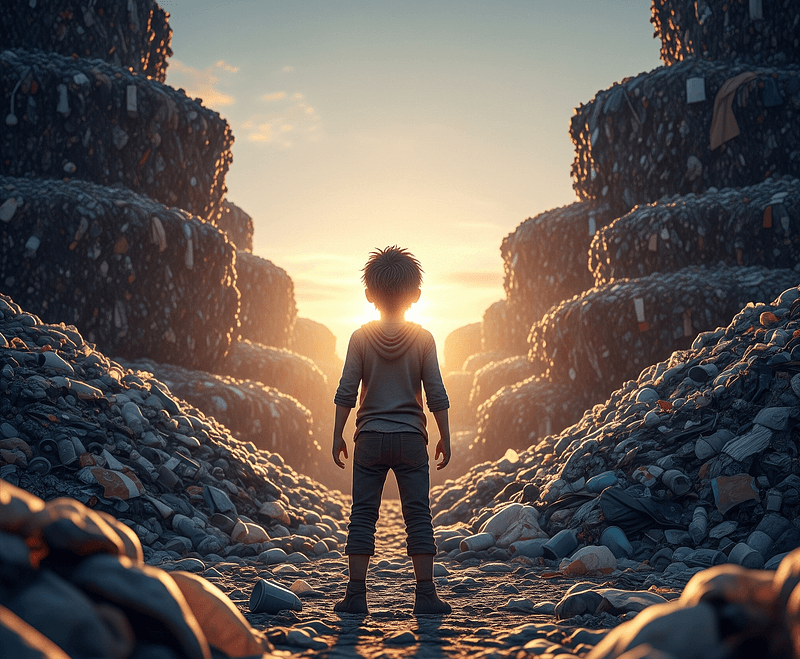

And that belief is exactly why I need to be honest: most of what gets built, funded, and hyped in Web3 solves problems nobody has. The critics are mostly right. But the fraction that works — stablecoins, cross-border payments, programmable finance — is genuinely transformative. This post is about the difference.

The 90% That Fails

You'll hear people throw around numbers like "95% of Web3 is useless." I don't know the exact percentage. What I do know is that the documented failure rate for Web3 projects is around 90%, and the scale of fraud is staggering. Here are the numbers:

- FTX — $11.3 billion in client assets. Only $2.3 billion recovered. Sam Bankman-Fried convicted of fraud, sentenced to 25 years.

- OM (Mantra) — token price crashed 90% in April 2025. Estimated losses: $5.5 billion.

- Hawk Tuah ($HAWK) — launched by an internet personality, reached $490 million market cap, crashed 90% within hours.

- SafeMoon — promised locked liquidity while insiders drained funds. SEC and DOJ brought fraud charges.

- Rug pulls overall — losses exploded from $1.3 million in 2022 to nearly $6 billion in early 2025.

In total, $17 billion was lost to crypto scams and fraud in 2025 alone. The industry eliminated the fraud protections that traditional finance spent decades building — insurance, monitoring, reversible transactions — and expected users to manage security on their own. The result is predictable.

I'm not listing these to be contrarian. I'm listing them because pretending they don't exist makes it harder for the legitimate projects to be taken seriously.

What "Decentralized" Actually Means in Practice

Here's something most Web3 marketing won't tell you: the vast majority of "decentralized" applications are just regular apps with a wallet login. The actual on-chain part is often limited to a token or a single smart contract — everything else runs on the same centralized infrastructure as any other web app.

I know this firsthand. Moonly's codebase is an NX monorepo with 36 applications. Three of them are Anchor smart contracts — staking, raffles, and project staking. The other 33 are Next.js frontends, GraphQL APIs, PostgreSQL databases, Redis caches, and BullMQ job queues. Standard full-stack web development. The blockchain handles what it's good at — trustless asset custody, verifiable state transitions, permissionless access — and everything else stays off-chain where it's faster and cheaper.

Kyle Samani from Multicoin Capital — one of the most prominent Web3 venture capitalists — publicly revised his thesis in 2025. His conclusion: blockchain is primarily a ledger. Not a platform for everything, not a replacement for the internet. A ledger. That's a much smaller claim than "Web3 will replace Web2," and it's a much more honest one.

What Actually Works: Payments

I live in Khulna, Bangladesh. When a client pays me through the traditional banking system, it involves multiple intermediary banks, wire transfer fees of $25-45, and a waiting period of 3-5 business days. Sometimes longer if there's a banking holiday in either country.

When a client sends me USDC on Solana, the money arrives in three seconds. The transaction fee is less than a cent. No intermediaries, no business hours, no correspondent banks. This is not hypothetical — this is how I actually get paid.

The numbers back this up. Stablecoins processed $33 trillion in transactions in 2025 — a 72% increase from the previous year. Cross-border remittance costs average 6.5% through traditional services. Through crypto, it's around 1%. By April 2025, 26% of U.S. remittance senders had used stablecoins at least once. Africa's crypto adoption grew 45% year-over-year, driven almost entirely by practical payment use cases — not speculation.

Western Union is evaluating Solana for remittance pilots. JPMorgan ran a pilot with Indian banks for real-time USD settlement on blockchain infrastructure. These are not crypto-native startups chasing hype — these are legacy financial institutions recognizing that the rails are better. Stablecoins are the most boring blockchain use case and the most transformative one.

Show Me the Code

When I say a stablecoin transfer is simple, here's what I mean. This is a USDC transfer on Solana using the standard SPL token library:

import { Connection, Keypair, PublicKey } from "@solana/web3.js";

import {

getOrCreateAssociatedTokenAccount,

transfer,

} from "@solana/spl-token";

// USDC mint address on Solana mainnet

const USDC_MINT = new PublicKey(

"EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v"

);

async function sendUSDC(

connection: Connection,

sender: Keypair,

recipient: PublicKey,

amount: number // in USDC

) {

const senderATA = await getOrCreateAssociatedTokenAccount(

connection, sender, USDC_MINT, sender.publicKey

);

const recipientATA = await getOrCreateAssociatedTokenAccount(

connection, sender, USDC_MINT, recipient

);

const signature = await transfer(

connection,

sender,

senderATA.address,

recipientATA.address,

sender,

amount * 1e6 // USDC has 6 decimals

);

return signature; // confirmed in ~3 seconds

}That's it. No smart contract deployment. No gas fee optimization. Just a standard SPL token transfer — the same library you'd use for any Solana token. The USDC mint address EPjFWdd5...TDt1v is the real mainnet address. If you want to set up a Solana development environment and try this yourself, follow my Solana setup guide.

What Actually Works: Programmable Finance

Beyond payments, DeFi works when it replaces an actual intermediary with transparent, verifiable code. Solana's ecosystem is a good example of this working at scale — $11.5 billion in total value locked, over 50 million monthly active users, and more than 2,100 active dApps as of late 2025.

The staking contracts I built for Moonly are a concrete example. NFT holders stake their assets into the Mission program, earn token rewards over time, and participate in on-chain raffles. All state transitions happen on-chain — who staked what, when rewards accrued, who won the raffle. No custodial risk, no trust required in a central operator. The code is the authority.

But I want to be honest about the limits too. DeFi works when it genuinely removes an intermediary. It fails when it just adds blockchain complexity to a problem that a database solves better. Not every application needs trustless state. Most don't. If you want to understand the Anchor patterns behind programs like these, my Solana todo app tutorial covers the fundamentals — PDAs, realloc, account validation, the same building blocks I used in production.

Use the Tool for What It's Good At

Blockchain is a tool, not a religion. It solves a narrow set of problems very well — trustless asset custody, verifiable state, permissionless payments — and it's terrible at everything else. The scams and failures happen when people ignore that and try to decentralize things that don't need decentralizing.

If you're interested in Solana development, I've written a series of guides that cover the fundamentals: setting up the toolchain, deploying your first program, and building a complete todo app with Anchor. Build something that solves a real problem. That's the only test that matters.